- Jeff Swanson

- Posts

- Why Your Emergency Fund Is Losing You Money (And What To Do About It)

Why Your Emergency Fund Is Losing You Money (And What To Do About It)

The Emergency Fund Trap: How "Safe" Money Is Costing You Thousands

Your $13,800 emergency fund just cost you $61,400 in Bitcoin gains. And Dave Ramsey’s advice is keeping you broke.

Let me be blunt: keeping cash for “emergencies” is financial advice for people who don’t understand how money actually works. While you’re proudly earning 0.5% in your savings account, inflation is quietly stealing 7% of your purchasing power every single year.

That’s not safety. That’s guaranteed wealth destruction.

The Emergency Fund Lie

First, let’s define what we’re talking about. An emergency fund is cash—sitting in a savings account—set aside for unexpected expenses like job loss, medical bills, or major home repairs.

Dave Ramsey’s formula is treated as sacred doctrine in traditional personal finance circles:

Step 1: Save $1,000 as your “starter emergency fund”

Step 2: Pay off all debt (except your mortgage)

Step 3: Build 3–6 months of living expenses in cash

For someone in their 20s spending around $2,000 per month on essentials, that means eventually parking $6,000–$12,000 in a savings account earning maybe 3%—if you’re lucky. For higher earners spending $4,000–$5,000 per month, that’s $12,000–$30,000 just sitting idle, doing nothing while inflation quietly erodes its value.

Why Emergency Funds Are Wealth Killers

When you build an emergency fund, that’s a lot of your money sitting idle—not working for you. Wealthy people don’t like to keep cash doing nothing, and you shouldn’t either. If you have money parked in a savings or checking account, it’s losing around 6% of its purchasing power each year to inflation. You feel it every time the cost of living goes up.

But Jeff, inflation is only 2–3% based on the CPI number, right? That’s not a real number. It’s engineered to appear low. A far better metric is the growth of the M2 money supply—a measure of the total amount of money available in the economy, including cash in circulation plus deposits that can be quickly converted to cash. It’s broader than M1, which mainly includes physical currency and checking deposits.

In simple terms, M2 represents money that people can readily spend or convert to cash in the short term, making it a key indicator of how much money is available for immediate economic use. This value inflates every time new money is printed. Over the past two years, M2 has grown at an annual rate of about 6%—a figure that better reflects the price increases you’re seeing at the grocery store, in rent, and in healthcare costs.

Here’s the shocker: with 6% inflation (i.e., expansion of the M2 supply), your savings will lose roughly 50% of its value in just 12 years. That’s half of your work, effort, and savings—gone. It’s a massive problem when you’re saving in cash.

Even if you’re earning 4% interest in a “high-yield” savings account, real inflation is closer to 6%. That means your money is still losing value every single year.

That’s not safety—that’s guaranteed wealth destruction.

Missing Out On Compounding

But here’s the bigger problem: how often do you actually need this money? Most people go years—sometimes decades—without ever touching their emergency fund. Meanwhile, every dollar sits idle, missing out on the compounding growth of appreciating assets.

This is especially devastating for people in their 20s and 30s. These are your prime wealth-building years—the years when compound interest does the heavy lifting. Every dollar you park in cash instead of Bitcoin is a dollar that could be compounding exponentially over the next 20–30 years.

We all understand the principle: the longer you let investments compound, the greater the outcome. Starting early is everything. The earlier you invest, the more the math works in your favor.

We’re living through the early adoption phase of the hardest money ever created. While you’re following Dave Ramsey’s advice to keep $10,000 in cash “just in case,” that same $10,000 could be working for you—quietly growing into life-changing wealth in Bitcoin.

The Bitcoin Emergency Strategy

In the post-fiat world, Bitcoin can be viewed as a true savings account. It can’t be inflated, and over time it naturally appreciates in value—the way real money is supposed to work.

With that in mind, placing your savings in Bitcoin allows you to exit the inflationary fiat system and benefit from the early exponential growth of the Bitcoin network. As adoption accelerates and scarcity asserts itself, this growth can become substantial over the years—compounding quietly in the background while fiat continues to lose purchasing power.

Getting Started

This is for those just getting started. You might be in high school or college and want to begin saving, or maybe you’re in your early 20s, launching your career. In this case, you can create an emergency fund by purchasing Bitcoin. You can do this through an exchange and then transfer it to your personal Bitcoin wallet.

Now, I’m not going to get into the details of how to buy and store Bitcoin here—that’s for another article. But instead of parking your money in a savings account, you simply buy Bitcoin.

So what happens when you suddenly get hit with a $2,000 car repair? Here’s what I’d do. In my late 20s and early 30s, when car repairs or other unexpected expenses popped up, I’d either put it on a credit card and pay it off quickly, or sell a small portion of stock from my brokerage account. Once, I even took out a small loan against my investments. Simple. Effective. And most importantly—my money kept working for me instead of rotting in a checking account.

Taking a loan against your Bitcoin is even easier—no credit check required. Your Bitcoin is your credit score. It’s pristine collateral. The bonus of this approach is that you get to keep your Bitcoin while paying off your emergency expense. This is exactly what wealthy people do—they never sell appreciating assets. Remember, dollars are cheap—use dollars to pay your bills and keep your Bitcoin. Then, pay off your loan over time.

In reality, the number of times you’ll need to tap your emergency fund is rare, and usually for small amounts compared to what you’re saving. But here’s the bigger point: the money you’re saving in Bitcoin is growing.

Let’s look at an example: suppose you want to build a $15,000 emergency fund. Instead of saving cash, you decide to buy Bitcoin—investing $500 each month. Over time, you’re not just building an emergency fund; you’re building a compounding, appreciating safety net.

What if Bitcoin feels too scary? What if you don't trust it yet?

Here's another option: park your emergency fund in something like STRC (Strategy Core Income) or STRF (Strategy Fixed Income), which currently yield north of 7%—STRC at 10.39% and STRF at 8.73%. At least you're matching—or even slightly beating—the debasement of your melting fiat.

These are income-generating perpetual preferred stocks from Strategy (formerly MicroStrategy) that pay high monthly (STRC) or quarterly (STRF) distributions from the company's general funds, bolstered by its substantial Bitcoin treasury. They're designed to provide stable income supported by Strategy's Bitcoin holdings—without requiring you to hold Bitcoin directly.

Think of them as a stepping stone. They won't give you pure Bitcoin exposure, but they let you benefit from Bitcoin's upside indirectly while generating consistent income that actually keeps pace with (or beats) real inflation. You get regular distributions, lower volatility than holding Bitcoin outright, and a yield that protects your purchasing power instead of watching it erode.

The key insight: Even if you're not ready to hold Bitcoin directly, you don't have to stay stuck in assets that guarantee you'll lose purchasing power. Better options exist right now—options that let you participate in Bitcoin's growth indirectly while generating meaningful income.

More Strategies If You're Older

If you're older, you likely have other tools at your disposal for emergency funds. Here are some ideas worth considering:

Home Equity Line of Credit (HELOC)

If you own your home, a HELOC gives you access to a revolving credit line based on your home's equity. Interest rates are typically lower than credit cards, and you only pay interest on what you actually use. Think of it as a safety net you set up before you need it—because banks are happy to lend when you don't need money, but reluctant when you do.

Credit Cards with Promotional Rates

Many credit cards offer 0% APR introductory periods (12-18 months) on purchases or balance transfers. If used strategically, these can bridge short-term cash flow gaps without touching your invested assets. The key is discipline—pay off the balance before the promotional period ends, or you'll face hefty interest charges.

Life Insurance Policy Loans

If you have a whole life or universal life insurance policy with cash value, you can borrow against it at relatively low interest rates. The loan doesn't require credit checks or approval processes, and you're technically borrowing from yourself. Just be aware: unpaid loans reduce your death benefit, so use this option carefully.

Why This Matters

The goal isn't to use these tools regularly—it's to have them available so your emergency fund can work harder. Instead of keeping $20,000 sitting in a 0.5% savings account "just in case," you could keep $5,000 liquid and invest the rest in higher-yield assets like STRC, STRF, or even Bitcoin—knowing you have backup options if a real emergency hits.

Financial flexibility means having multiple layers of protection, not just one massive pile of idle cash losing value to inflation.

"But What If Bitcoin Crashes During My Emergency?"

This is the objection everyone raises—and it completely misses the point.

First, Bitcoin’s volatility has dropped sharply since the ETF launch in January 2024. Ninety-day realized volatility fell below 40% for the first time ever, compared to pre-ETF levels that often exceeded 60%. Institutional money is now providing a stability floor that didn’t exist before.

Second, true emergencies requiring large sums of cash are rare. Most “emergencies” are a few thousand dollars—something you can handle with a credit card or a small loan against your Bitcoin. In the rare case of a genuine catastrophe, yes, you might need to sell some Bitcoin or borrow from family or friends. But those situations are few and far between.

In short, keeping an “emergency fund” in a low-yield savings account means you’re sacrificing precious compounding time. That idle cash could be growing in an appreciating asset instead of melting under inflation.

The Age Factor: Why This Works Best for Young People

If you're under 40, this strategy is a no-brainer. You likely don't have access to HELOCs or significant credit lines yet, but you have something more valuable: time.

Every dollar you put into Bitcoin instead of a savings account has 30+ years to compound. At Bitcoin's historical average returns, that emergency fund money could become generational wealth.

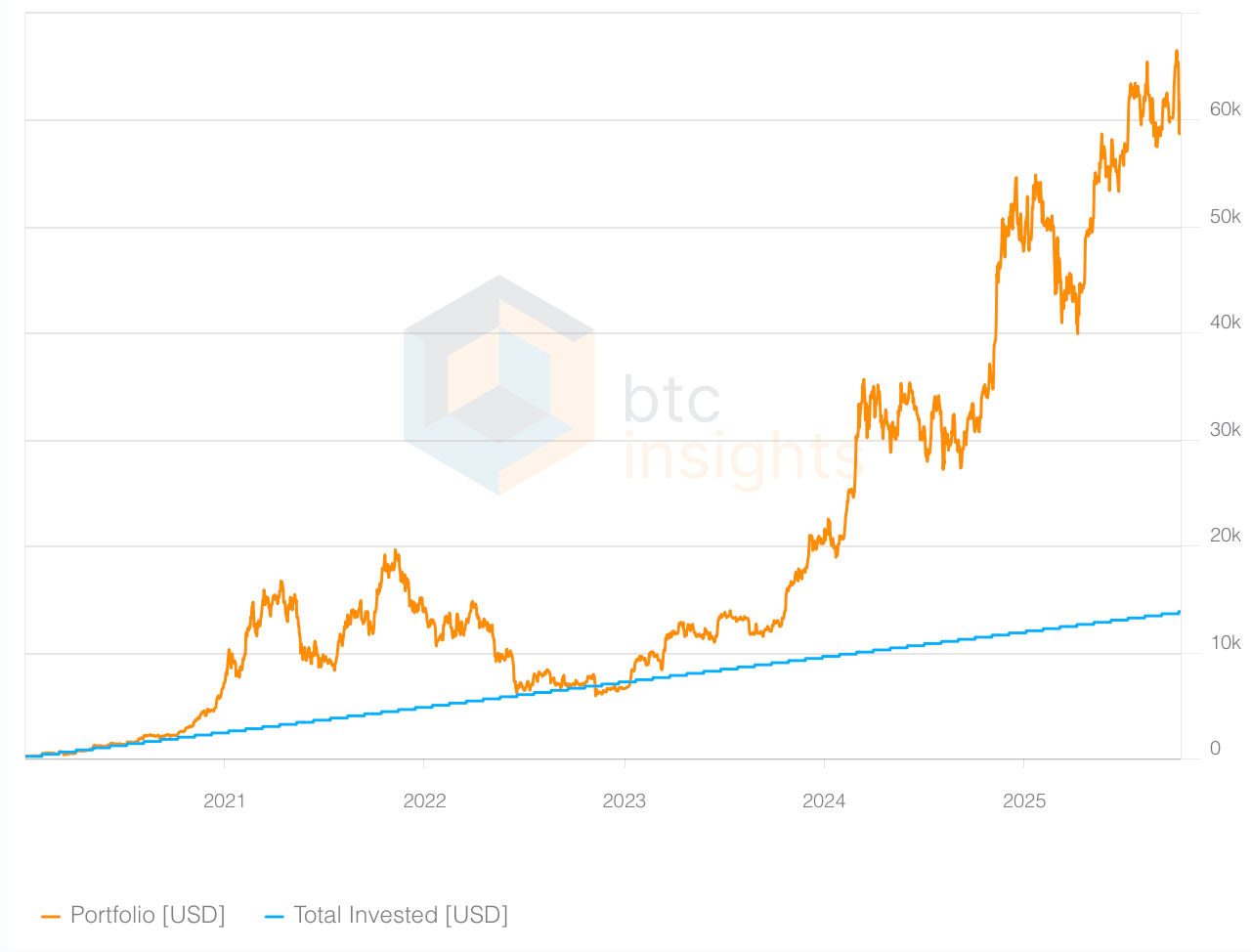

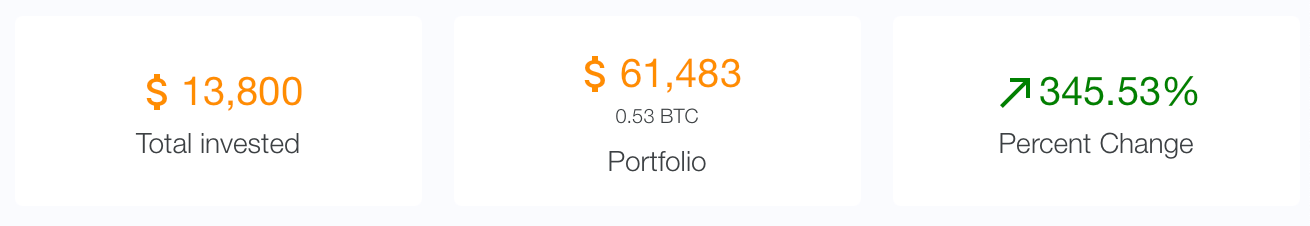

Below is an example of saving $200 per month (your “emergency fund” money) since 2020. The total invested would be $13,000—a decent emergency fund if you’d kept it in a checking or savings account.

But what if, instead, you had saved that same amount in Bitcoin?

Your $13,000 would have accumulated roughly 0.54 BTC, which today is worth about $61,483. That’s a 345% return—from the exact same monthly savings habit.

See the point? The difference isn’t discipline—it’s where you store your value.

As you mature, you gain access to more sophisticated liquidity options. Multiple credit lines, asset-backed lending, policy loans—the wealthy don't keep cash emergency funds because they understand how to access liquidity without sacrificing growth.

Dave Ramsey Is Wrong (And He Knows It)

Dave Ramsey built his fortune in real estate, not savings accounts. He understands leverage, asset appreciation, and cash flow. But he sells financial advice to people drowning in debt who need training wheels.

His emergency fund advice? Training wheels.

The problem is most people never take them off. They follow "Baby Steps" designed for financial recovery and mistake them for wealth-building strategies.

Here's the reality: wealthy people don't keep large cash emergency funds. They keep assets that can be converted to liquidity when needed.

The New Emergency Fund: Options, Not Cash

Instead of dead money in savings, build optionality:

Bitcoin as your base layer - Growing wealth that can be borrowed against.

Credit access - Cards, lines of credit

Asset-backed lending - Borrow against Bitcoin without selling

Multiple liquidity sources - Never depend on just one option

This isn't about being reckless. This is about being smart with your capital allocation while building multiple safety nets that don't cost you compound growth.

The Bottom Line

Every month your emergency fund sits in cash, you're making a choice: guaranteed losses to inflation versus potential Bitcoin volatility.

I'll take potential volatility in an appreciating asset over guaranteed destruction in a depreciating one every single time.

Your emergency isn't going to be not having cash available. Your emergency is going to be reaching retirement age and realizing that following conventional wisdom kept you broke.